ONLINE with the Social Law Library

November 9, 2022 4:00 – 6:00 pm

This program will be recorded – anyone who registers will receive all program materials and video link.

For more information and to register –

https://www.socialaw.com/education/event-detail/2022/11/09/default-calendar/double-counting-issues-in-equitable-distribution-and-support---fair-or-not

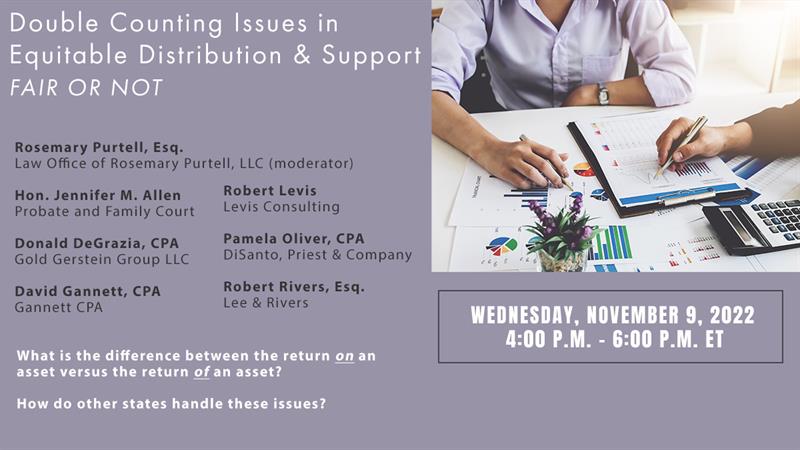

What is the difference between the return on an asset versus the return of an asset?

How do other states handle these issues?

The questions surrounding the double counting of assets and/or income is raised in many of our domestic relations cases, both in the division of marital assets in divorce and for support purposes. The issues raised are not just related to the valuation of closely-held family businesses, but also involve the valuation of and use of income from pensions, stock options, tax refunds, and even bank accounts. It is important that practitioners understand the current state of Massachusetts law on these topics in order to make a successful argument depending upon whom you represent. When and to what extent is the income from a business whose value has been established not to be counted for purposes of support? Why can income from an assigned asset be used for child support but perhaps not for alimony calculations?

Attendees can expect to learn:

- How Massachusetts’ equitable division theory impacts claims of “double dipping” in divorce.

- How best to convince the judge that your theory is the right one.

- How the methodology used to value a business can potentially avoid the “double dipping” argument. What is impermissible double counting and what is not?

- The impact of the new Child Support Guidelines and the Alimony Reform Act on valuation and support issues.

Program Faculty –

Rosemary Purtell, Esq., Law Office of Rosemary Purtell, LLC (moderator)

Hon. Jennifer M. Allen, Probate and Family Court

Donald DeGrazia, CPA, Gold Gerstein Group LLC

David Gannett, CPA, Gannett CPA

Robert Levis, Levis Consulting

Pamela Oliver, CPA, DiSanto, Priest & Company

Robert Rivers, Esq., Lee & Rivers

For assistance, questions on group discounts, accommodations requests, special billing, program content, out-of-state CLE credits, and general CLE information contact Michael Saporito by email at msaporito@socialaw.com. Registrations accepted in order of receipt. Registration fees are non-refundable. Most Social Law Library CLE events are recorded and the recording is emailed to those who have registered. When programs qualify for CLE credit, credit is only granted when attending the live program, not just for watching the video.